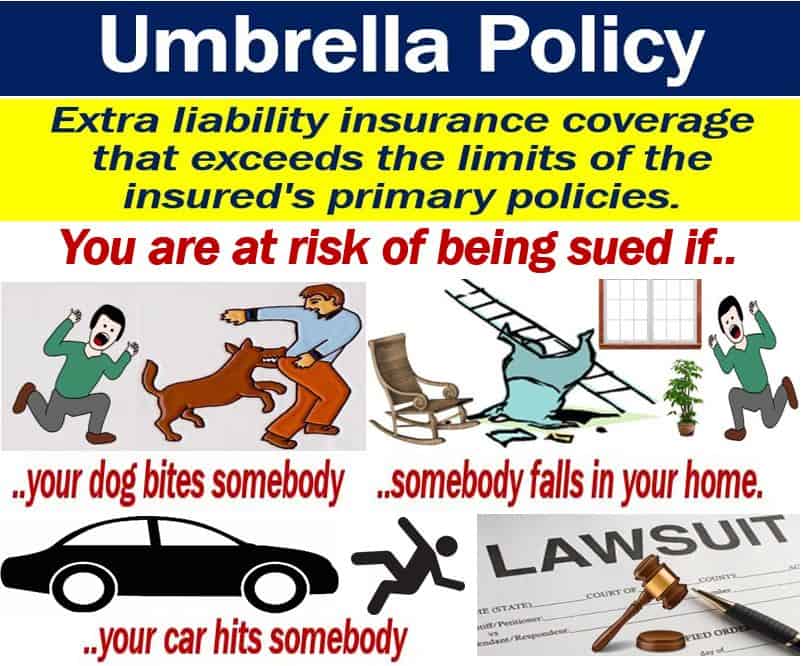

What Does Umbrella Policy Mean . umbrella insurance is a type of personal liability insurance that can cover claims in excess of the limits of your regular insurance policy. umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance policies. umbrella insurance provides additional liability coverage beyond what is offered by other policies, such as home or auto insurance. An umbrella policy helps to protect your assets,. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. umbrella insurance is enhanced liability protection that supplements your homeowners insurance and auto insurance. an umbrella insurance policy is a type of personal liability coverage that covers claims that exceed your homeowners or auto insurance limits. umbrella insurance provides a lot of coverage, starting at $1 million, for a low cost.

from marketbusinessnews.com

An umbrella policy helps to protect your assets,. umbrella insurance provides a lot of coverage, starting at $1 million, for a low cost. umbrella insurance is enhanced liability protection that supplements your homeowners insurance and auto insurance. umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance policies. umbrella insurance is a type of personal liability insurance that can cover claims in excess of the limits of your regular insurance policy. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. umbrella insurance provides additional liability coverage beyond what is offered by other policies, such as home or auto insurance. an umbrella insurance policy is a type of personal liability coverage that covers claims that exceed your homeowners or auto insurance limits.

What is an umbrella policy? Definition and some examples

What Does Umbrella Policy Mean umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance policies. An umbrella policy helps to protect your assets,. umbrella insurance is a type of personal liability insurance that can cover claims in excess of the limits of your regular insurance policy. umbrella insurance provides additional liability coverage beyond what is offered by other policies, such as home or auto insurance. umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance policies. umbrella insurance provides a lot of coverage, starting at $1 million, for a low cost. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. an umbrella insurance policy is a type of personal liability coverage that covers claims that exceed your homeowners or auto insurance limits. umbrella insurance is enhanced liability protection that supplements your homeowners insurance and auto insurance.

From www.mymoneyblog.com

Here Are 11 Reasons We Have An Umbrella Liability Insurance Policy — My Money Blog What Does Umbrella Policy Mean umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. umbrella insurance is enhanced liability protection that supplements your homeowners insurance and auto insurance. umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance policies. umbrella insurance is a type of personal liability. What Does Umbrella Policy Mean.

From www.nj.com

What is umbrella insurance & how does it work? What Does Umbrella Policy Mean umbrella insurance provides additional liability coverage beyond what is offered by other policies, such as home or auto insurance. umbrella insurance provides a lot of coverage, starting at $1 million, for a low cost. An umbrella policy helps to protect your assets,. umbrella insurance is enhanced liability protection that supplements your homeowners insurance and auto insurance. . What Does Umbrella Policy Mean.

From www.hillsia.com

Have you considered umbrella insurance? Here are some examples where it might come in handy What Does Umbrella Policy Mean umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance policies. umbrella insurance is enhanced liability protection that supplements your homeowners insurance and auto insurance. umbrella insurance is a type of personal liability insurance that can cover claims in excess of the limits of your regular insurance policy. an umbrella insurance. What Does Umbrella Policy Mean.

From www.annuityexpertadvice.com

What Is Umbrella Insurance & How Can It Help You? (2023) What Does Umbrella Policy Mean umbrella insurance provides additional liability coverage beyond what is offered by other policies, such as home or auto insurance. umbrella insurance is enhanced liability protection that supplements your homeowners insurance and auto insurance. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. umbrella insurance provides a lot. What Does Umbrella Policy Mean.

From www.hanover.com

How does an umbrella policy protect you? The Hanover Insurance Group What Does Umbrella Policy Mean umbrella insurance provides additional liability coverage beyond what is offered by other policies, such as home or auto insurance. umbrella insurance is enhanced liability protection that supplements your homeowners insurance and auto insurance. an umbrella insurance policy is a type of personal liability coverage that covers claims that exceed your homeowners or auto insurance limits. umbrella. What Does Umbrella Policy Mean.

From www.metlife.com

The Benefits of an Umbrella Policy MetLife What Does Umbrella Policy Mean An umbrella policy helps to protect your assets,. umbrella insurance is enhanced liability protection that supplements your homeowners insurance and auto insurance. umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance policies. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. . What Does Umbrella Policy Mean.

From www.pinterest.com

Umbrella Insurance Insurance 101 (newsletter article Mar 2015) Umbrella insurance, Insurance What Does Umbrella Policy Mean umbrella insurance is enhanced liability protection that supplements your homeowners insurance and auto insurance. umbrella insurance provides a lot of coverage, starting at $1 million, for a low cost. umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance policies. umbrella insurance is a type of personal liability insurance that can. What Does Umbrella Policy Mean.

From blog.cfmimo.com

Insurance That Educates Breaking Down How A Personal Umbrella Policy Works What Does Umbrella Policy Mean an umbrella insurance policy is a type of personal liability coverage that covers claims that exceed your homeowners or auto insurance limits. umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance policies. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. An. What Does Umbrella Policy Mean.

From assetplanningcorp.com

Time to Grab an Umbrella Insurance Policy? What Does Umbrella Policy Mean an umbrella insurance policy is a type of personal liability coverage that covers claims that exceed your homeowners or auto insurance limits. umbrella insurance provides additional liability coverage beyond what is offered by other policies, such as home or auto insurance. umbrella insurance is a type of personal liability insurance that can cover claims in excess of. What Does Umbrella Policy Mean.

From www.noyeshallallen.com

Should You Have a Personal Umbrella Policy? Blog Noyes Hall & Allen Insurance What Does Umbrella Policy Mean An umbrella policy helps to protect your assets,. umbrella insurance provides additional liability coverage beyond what is offered by other policies, such as home or auto insurance. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. umbrella insurance provides a lot of coverage, starting at $1 million, for. What Does Umbrella Policy Mean.

From mycalcas.com

Umbrella Insurance FAQs What Does Umbrella Policy Mean umbrella insurance is enhanced liability protection that supplements your homeowners insurance and auto insurance. umbrella insurance provides additional liability coverage beyond what is offered by other policies, such as home or auto insurance. umbrella insurance provides a lot of coverage, starting at $1 million, for a low cost. An umbrella policy helps to protect your assets,. . What Does Umbrella Policy Mean.

From dxofwzkmh.blob.core.windows.net

What Does An Personal Umbrella Policy Cover at Gene Ryan blog What Does Umbrella Policy Mean umbrella insurance provides additional liability coverage beyond what is offered by other policies, such as home or auto insurance. umbrella insurance is enhanced liability protection that supplements your homeowners insurance and auto insurance. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. an umbrella insurance policy is. What Does Umbrella Policy Mean.

From www.ramseysolutions.com

Umbrella Insurance How It Works and What It Covers Ramsey What Does Umbrella Policy Mean umbrella insurance is a type of personal liability insurance that can cover claims in excess of the limits of your regular insurance policy. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. umbrella insurance is enhanced liability protection that supplements your homeowners insurance and auto insurance. An umbrella. What Does Umbrella Policy Mean.

From www.bbbins.com

What is Umbrella Insurance and Why Do I Need It? Burke, Bogart & Brownell What Does Umbrella Policy Mean umbrella insurance provides additional liability coverage beyond what is offered by other policies, such as home or auto insurance. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. umbrella insurance provides a lot of coverage, starting at $1 million, for a low cost. An umbrella policy helps to. What Does Umbrella Policy Mean.

From www.youtube.com

RLI Explains What is a Personal Umbrella Policy? YouTube What Does Umbrella Policy Mean umbrella insurance is a type of personal liability insurance that can cover claims in excess of the limits of your regular insurance policy. umbrella insurance provides a lot of coverage, starting at $1 million, for a low cost. umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance policies. umbrella insurance. What Does Umbrella Policy Mean.

From www.connectbyamfam.com

What is Umbrella Insurance? CONNECT umbrella insurance What Does Umbrella Policy Mean umbrella insurance provides additional liability coverage beyond what is offered by other policies, such as home or auto insurance. umbrella insurance provides a lot of coverage, starting at $1 million, for a low cost. An umbrella policy helps to protect your assets,. umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance. What Does Umbrella Policy Mean.

From www.investopedia.com

How an Umbrella Insurance Policy Works What Does Umbrella Policy Mean umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance policies. An umbrella policy helps to protect your assets,. an umbrella insurance policy is a type of personal liability coverage that covers claims that exceed your homeowners or auto insurance limits. umbrella insurance provides a lot of coverage, starting at $1 million,. What Does Umbrella Policy Mean.

From marketbusinessnews.com

What is an umbrella policy? Definition and some examples What Does Umbrella Policy Mean umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance policies. umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. umbrella insurance provides additional liability coverage beyond what is offered by other policies, such as home or auto insurance. umbrella insurance provides. What Does Umbrella Policy Mean.